Stock Market Crashes in India in 2025

On May 10, 2025, the Indian stock market experienced a sharp and sudden downturn, catching many investors off guard. If you’re one of the people watching the Sensex or Nifty plummet, you’re not alone. Stock market crashes, while unsettling, are a natural part of investing. But how did this particular crash happen, and what can you take away from it?

The Drop:

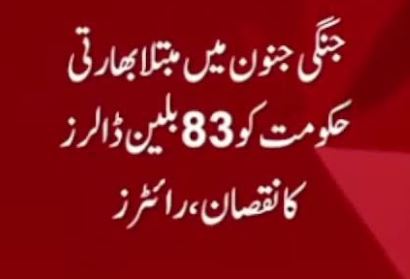

On May 10, 2025, the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) witnessed a dramatic fall. The Sensex and Nifty both dropped by significant margins, causing widespread panic among retail and institutional investors alike. Stocks across nearly every sector saw steep declines. The market lost billions in just a matter of hours, creating chaos in both trading rooms and households.

While crashes of this magnitude often have a mix of reasons behind them, it’s safe to say this one took many by surprise. So, what caused this particular crash?

Key Reasons Behind the May 10 Crash

- Global Economic Shocks

One of the main triggers was global uncertainty. Major international markets were facing turbulence, with growing fears of a potential global recession. Uncertainty around the US Federal Reserve’s interest rate hikes and a slowdown in global trade made investors nervous, leading to a sell-off in global stock markets, including India’s. - Domestic Concerns: Inflation and Rising Interest Rates

Back home in India, inflation continued to climb, causing the Reserve Bank of India (RBI) to increase interest rates in an attempt to control it. Higher interest rates tend to slow down economic growth, which worries investors about corporate profitability and future growth prospects. This added fuel to the fire and led to a pullback in the markets. - Investor Panic

Fear can drive a market down faster than anything else. As stocks began to fall, many investors started selling off their shares in a panic. When everyone is trying to get out at once, the market drops faster than it might have otherwise. This fear-driven selling led to a snowball effect that intensified the crash. - Corporate Earnings Miss Expectations

Many large companies in India reported weaker-than-expected earnings for the first quarter of 2025. This disappointment caused investors to rethink their outlook for the Indian economy, sending stock prices spiraling downward.

What Does This Mean for Investors?

If you’re an investor, the drop on May 10 may feel like a gut punch. But before you panic, let’s take a moment to consider a few important things:

- Crashes Are Part of the Market

Stock market crashes, while unsettling, are not new. They’ve happened before and will happen again. The key is not to overreact. After every crash, the market typically recovers, though it might take time. Investors who stay calm and don’t sell in a panic usually fare better in the long run. - Opportunity in the Chaos

While it may seem counterintuitive, market crashes can present opportunities for savvy investors. If you have cash on hand and a long-term mindset, this could be an ideal time to buy stocks at a lower price. Some companies that dropped sharply in value may still have strong fundamentals, meaning they could bounce back as the market stabilizes. - Diversify Your Portfolio

A diversified portfolio can help protect you during turbulent times. If you’re heavily invested in just one sector or stock, a crash can hit you harder. Spreading your investments across various sectors (and even asset classes like bonds or real estate) can help cushion the impact of a crash. - Focus on Long-Term Goals

For long-term investors, this crash should be just a blip on the radar. Market volatility is normal, and if you’re investing with a long-term horizon, these short-term fluctuations may not matter much. Stick to your plan, and don’t let short-term noise distract you from your bigger financial goals.

What’s Next? Will the Market Recover?

While it’s impossible to predict exactly how the market will behave in the coming weeks and months, history has shown that markets tend to bounce back. In fact, many investors see market corrections (a drop in stock prices of 10% or more) as an opportunity to buy in at lower prices before the market starts to climb again.

If you’re feeling uncertain, remember that the Indian stock market has weathered plenty of storms in the past, from the 2008 global financial crisis to the 2020 pandemic crash. The key is to stay informed, stay calm, and make decisions based on your personal financial goals, not on short-term market noise.